Kareem Fund for Microfinance

Kareem means dignity in Arabic. Kareem Fund is a microfinance project based on group lending as per Grameen international policies which aims to help destitute Syrians earn a living in dignity. It is an economic, social and development project that has so far taken beneficiaries out of poverty.

Kareem Fund offers loan services to men and women on favorable terms, entrenches a culture of productivity and self-independence, and provides sustainable self-employment job opportunities for Syrians.

Kareem Fund project provides an opportunity to those who have the skills, capacity and desire for self-employment to receive the required capital to push their private activities forward, develop those activities which will help create new job opportunities and increase their income.

Provide self-employment to both women and men beneficiaries

Convert families benefiting from aid/relief to productive families capable of earning a living in dignity

Contribute to the social and economic empowerment of women and supporting their role within their families and society as a whole

Entrench a culture of producing rather than consuming, as well as independence from relief/aid

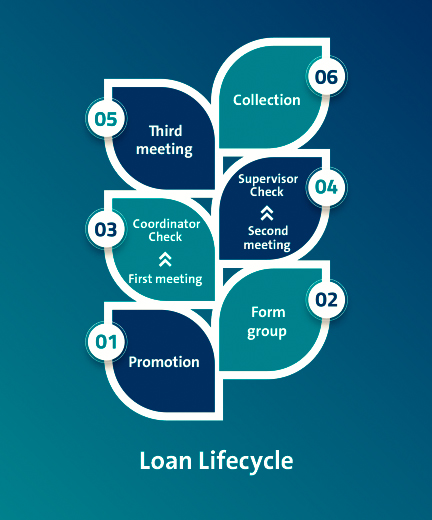

Loan Lifecycle

The project team starts by promoting the lending services and explaining its benefits to the citizens in meetings organized in cooperation with local authorities, so that those wishing to obtain the lending opportunity to form groups – according to the project policies- have been informed and can apply for a loan. Afterwards, a first meeting is held by the project coordinator where he conducts field visits to investigate and verify the reputation and seriousness of applicants. This is followed by a second meeting and the visit of the project supervisor to the applicants to ascertain their need and ability to make the project a success. After the approval of the project management, a third meeting is held which is the delivery meeting where the loans are disbursed. Refunds from borrowers are collected to be returned to new borrowers through a new cycle.